![]() Home prices continue to escalate, and talk of another housing bubble is brewing. But is there any truth to it?

Home prices continue to escalate, and talk of another housing bubble is brewing. But is there any truth to it?

The answer depends on whom you ask.

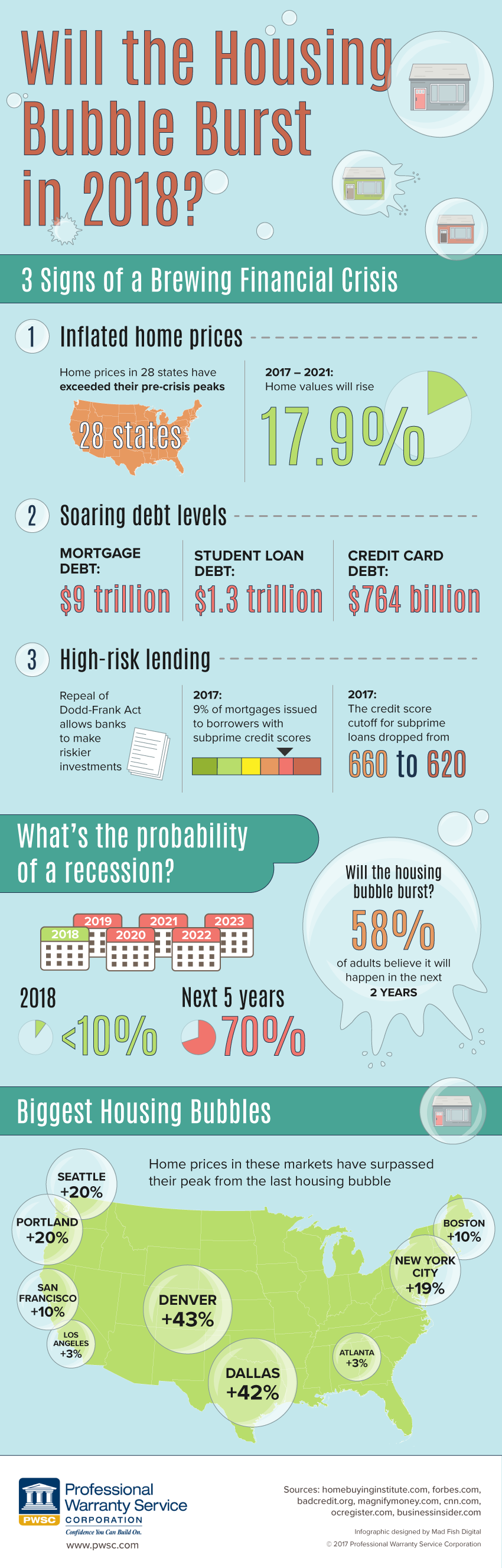

As the housing market becomes increasingly unaffordable for many Americans, nearly three in five adults speculate that it’s headed for a bubble and price correction in the next two years. Housing bubbles occur when consumers and investors are willing to pay more for homes because they think prices will increase indefinitely. They burst when prices reach unsustainable levels and demand drops while supply increases, causing prices to plummet.

Many industry experts insist there’s no bubble this time around. The last housing crisis was fueled by risky lending practices, which have since been curtailed. Instead of the high levels of subprime mortgages back in the early 2000s, today’s buyers have an average credit score well above 700. Plus, the current 6.5 percent annual growth of home prices remains below bubble-level rates, which grew 7.5 percent or more each year between 2002 and 2006, leaping as high as 16 percent in 2005.

“The market is expensive, competitive and unaffordable, but there’s no evidence of a bubble,” says Redfin economist Nela Richardson.

Yet some analysts point out that many of the economic conditions that led to the previous housing bubble have re-emerged.

“The same behaviors that real estate buyers displayed in the housing mania that exploded in the United States in the 2002–2006 period are back,” says analyst Alessandro Bruno. “The problem now might not stem so much from risky subprime mortgage debt repackaged into risky derivatives. The current problem is simpler: Buyers might be paying too much for the houses they buy.”

Signs of a brewing financial crisis

Although many industry experts agree there’s no housing crisis on the horizon, the likelihood of a recession in the next five years is high at 70 percent, and home values are likely to deflate in the near future. Home price cycles typically last seven to ten years, which means “historical precedent is now on the side of those who think a housing market correction is near,” says Trulia economist Ralph McLaughlin.

That doesn’t necessarily mean we’re in a housing bubble—but some analysts are pointing to potential warning signs such as:

Inflated home prices. Home values are expected to grow nearly 18 percent over the next four years, and in 28 states they’ve skyrocketed past their pre-recession peaks to set record highs. In several of the nation’s largest cities—such as Denver, whose pricing index has climbed 43 percent higher than its peak during the last housing bubble—homes are overvalued at 10 percent or more over what’s considered economically sustainable.

Soaring debt levels. Credit card debt is climbing once again, topping $764 billion this year. With mortgage debt at $9 trillion and overall household debt reaching $12.73 trillion, Americans may be in danger of overextending their credit. But the real danger comes from the nation’s $1.3 trillion in student loan debt. Unable to earn enough to pay back their loans, nearly half of college grads are behind on their payments, and defaults are escalating.

High-risk lending. Although banks clamped down on subprime lending in the wake of the recession, they’re once again loosening their criteria—especially with the repeal of the Dodd-Frank Act. Nearly 10% of mortgages this year were issued to borrowers with subprime credit scores, and the nation’s two biggest mortgage lenders have lowered their credit score cutoff for subprime loans from 660 to 620, resulting in weaker mortgages.

More than a third of Freddie Mac’s loans are credit enhanced, says William Poole, a senior fellow at the Cato Institute. That means “they carry mortgage insurance of one sort or another, which is typically used for weaker mortgages. If these weak subprime mortgages begin to fail in large numbers, so also will the insuring companies.”

Who’s at greatest risk?

The nation as a whole may not be in danger of a housing bubble just yet, but that doesn’t mean they aren’t happening locally as home prices in many markets continue to balloon past their unstable highs of the last bubble.

“Real estate is local. Therefore real estate bubbles are local,” says Business Insider. “If enough local bubbles balloon at the same time, it becomes a national housing bubble.”

States with the highest risk include:

- California

- Texas

- Florida

- Washington

- Tennessee

- Colorado

- Oregon

- Nevada

For builders, who have felt intensifying pressure to help meet the skyrocketing demand for homes in many of these markets, a housing burst could mean getting saddled with a surplus of inventory whose value no longer justifies the escalating costs of building.

Rising home prices mean added assurances become even greater in importance. New homes with home builder warranties may be more attractive to buyers. As home buyers are forced to dedicate a higher percentage of their income to mortgage payments, home builder warranties help mitigate the risk of having to make a major home repair they can’t afford. With builder structural coverage as a part of the new home package, they don’t have to shoulder the risk of buying a home that might experience an expensive failure in the near future and those potential added costs.

While it’s impossible to predict what the housing market will do over the next few years, one thing is certain: Mitigating risks, where possible, for buyers may be something builders need to prioritize. Housing bubble or not, home builder warranties benefit builders and buyers alike and provide an extra layer of confidence in these uncertain times.